Annuities have provided retirees with a safe and secure retirement solution for generations. Deferred annuities have been a solid way to accumulate retirement

Read More

The most important thing about retirement is doing what makes you happy. What would you do with your time if you weren’t working 40 hours every week?

Read More

High earning professionals and executives need the ultimate in disability income protection without which they can jeopardize their financial future. It’s not

Read More

All of the various forms of life insurance – whole life, term life, variable life, universal life and the dozens of variations of each – can be distilled down

Read More

Vacation season is almost upon us and, for many Americans who haven’t traveled abroad in several years, their vacations have been years in planning. However

Read More

If you’ve ever played the Game of Life board game, it becomes clear that compressed into the colorful path there are various stages of life. Each stage holds

Read More

You're 25 and feeling alive. You're settling into life after university, paying off your debts and slowly figuring how to "adult". But with the responsibility

Read More

Thinking about retirement and fixed-income living can be overwhelming. Here are some things to consider when planning your retirement.

Read More

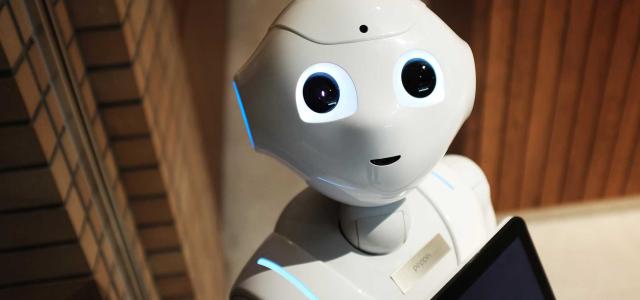

What’s the difference between a robo advisor and an actual financial advisor? It may seem like there’s an obvious answer - I mean one’s a software - but truly

Read More

When most people think about life insurance, it is something to be purchased when we’re young with financial responsibilities and dependents to protect. Any

Read More

Summer’s finally here. The sun is out, it’s warm, the days are longer, and your worries seem just a little bit further away. But folks, I’m sorry to say

Read More

If you’re a fan of political dramas on televisions, you’ll know that the turbulent world of politics has an affect on the global financial markets. But what

Read More